CPMs Find Hope In Private Market

Part of our STAQ Benchmarking Newsletter series

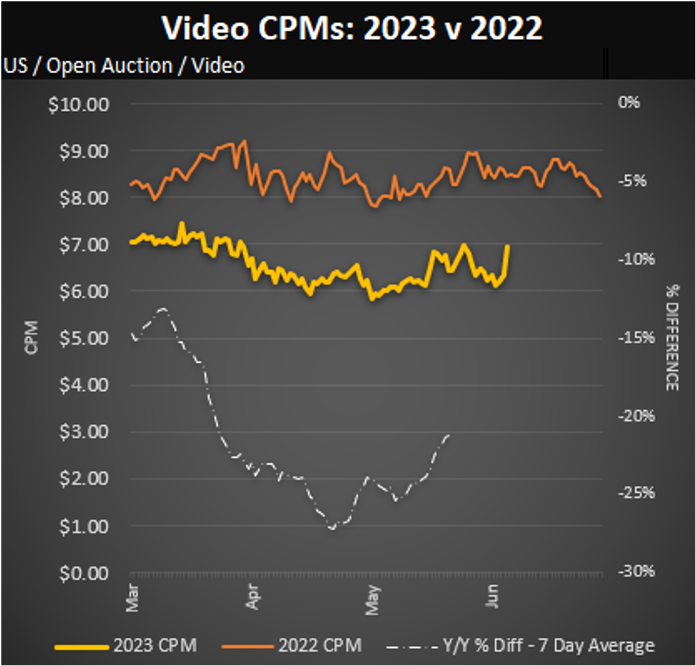

While Open CPMs were showing signs of growth earlier in June, they remained stagnant to close Q2 at about 10% below this time last year.

If previous year trends follow, we expect to see:

- A fairly significant drop in Open CPMs to start Q3, which fell 15% post July 4th in 2022

- A rise in mid-July with steady growth throughout the rest of the month.

It’s clear publishers continue to face challenges, but a few interesting trends have emerged that offer areas of opportunity in Q3.

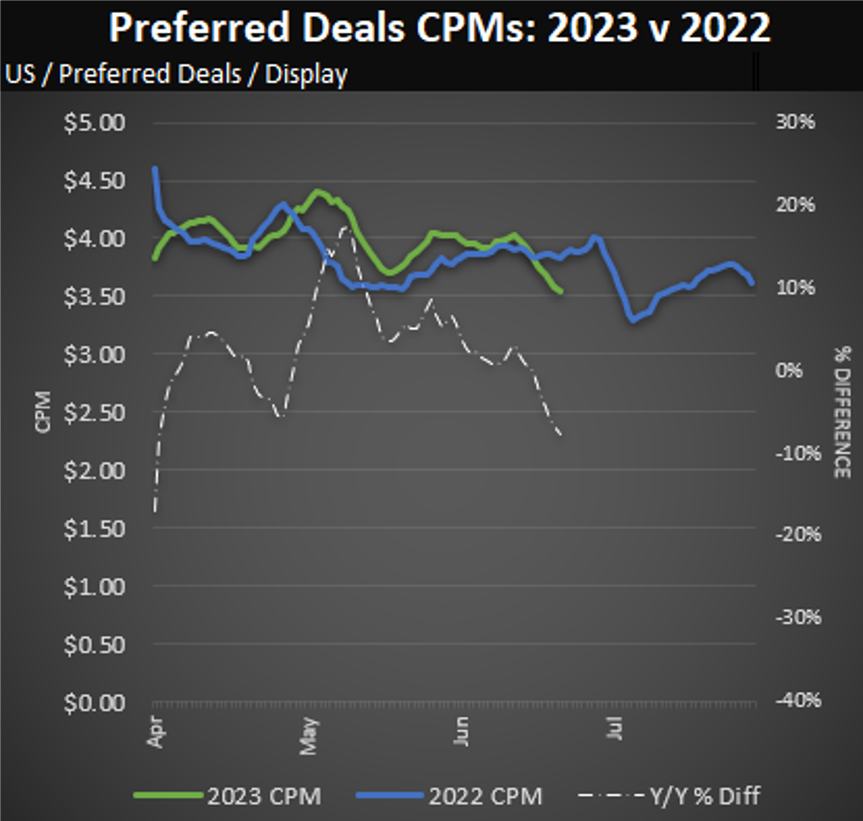

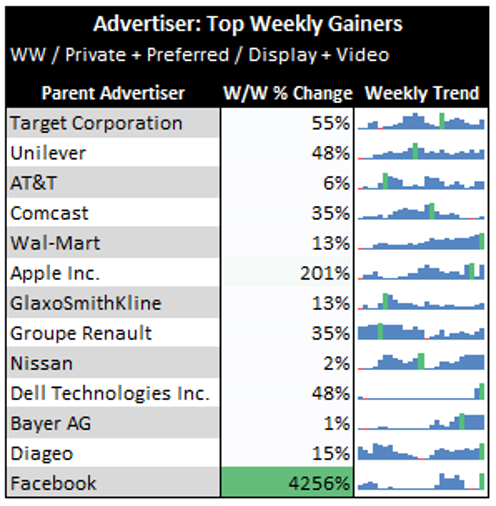

One of those is the Private market. In just the last week of Q2, Private Auction ad revenue was up 15% Y/Y and Preferred Deal was up a staggering 35%! While we usually see an end of quarter spike, it’s a good sign to see top advertisers like Target and Unilever increase their Private spend by 50% at the end of Q2. It’s also important to note that while Preferred Deal is currently holding strong, we did see CPMs drop at the start of Q3 in 2022, but bounce back in the 2nd week of July.

Overall Video CPMs have been down consistently about 20% from 2022, mostly due to Desktop. Mobile Video CPMs began to increase throughout June ending the quarter flat compared to last year. A good sign!

Additionally, we’ve seen Private Market Video CPMs hold strong against other transaction types. In June alone they grew over 5%, while Private CTV CPMs grew 10%.

While it remains to be seen if the momentum in Private will continue, these are positive trends to keep an eye on throughout the start of the new quarter.

We’ll continue to follow these trends and more and share our insights with you. Here’s to a successful Q3!

**Facebook growth is off of minimal spend the week prior